Earnings Limit For Social Security 2025 - Ford Defender 2025. 2025 land rover defender pricing and specs. 2025 land rover defender 90. […] Earnings Limit For Social Security 2025. 50% of anything you earn over the cap. Above that limit, beneficiaries lose $1 in benefits for.

Ford Defender 2025. 2025 land rover defender pricing and specs. 2025 land rover defender 90. […]

Who Won Belmont Stakes 2025. Arcangelo won the 2023 belmont stakes, the oldest and longest […]

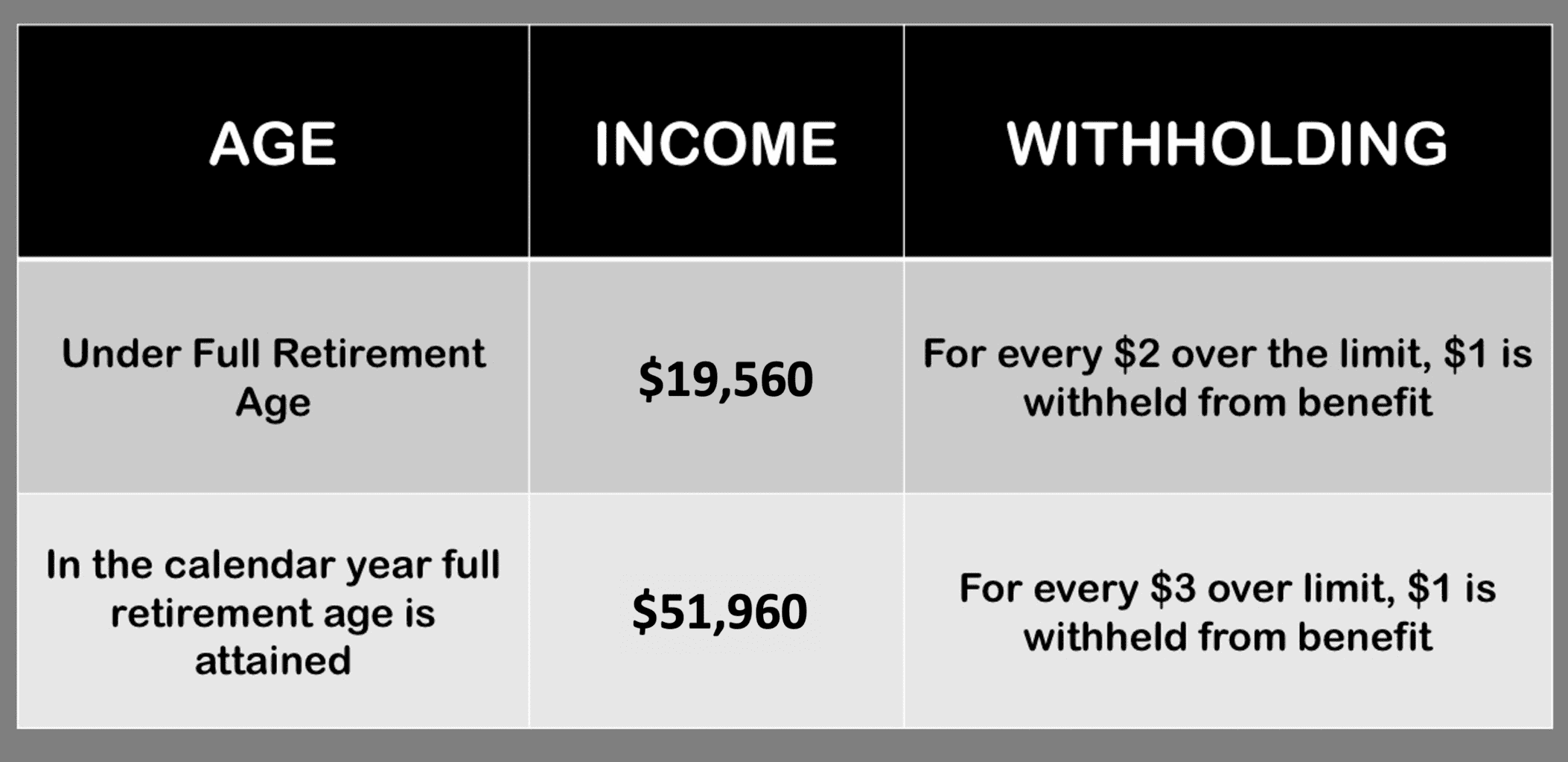

Limit For Maximum Social Security Tax 2025 Financial Samurai, In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit. Starting with the month you reach full retirement age, you.

Maximize Your Paycheck Understanding FICA Tax in 2025, The maximum benefit amount, however, is more than double that. Social security payment of $4,873 to go out this week.

Paying Social Security Taxes on Earnings After Full Retirement Age, Anyone born between the 21st and 31st of any month will have their benefits paid on april 24. Here's a look at the most you can.

2025 social security earnings limit Social Security Intelligence, In 2025, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every. Starting with the month you reach full retirement age, you.

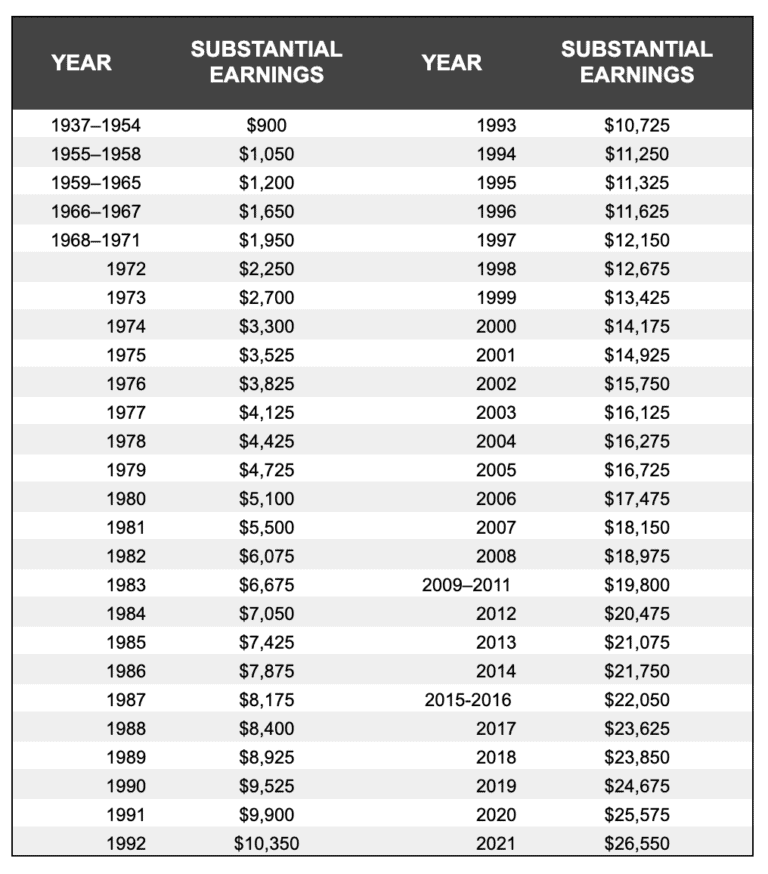

2023 Social Security, PBGC amounts and projected covered compensation, Keep these updated figures in mind if. Social security allows recipients to earn income from a job and also collect benefits at the same time.

Social Security Tax Limit 2025 Know Taxable Earnings, Increase, Starting with the month you reach full retirement age, you. In 2025, you can earn up to $22,320 without having your social security benefits withheld.

Ss Earning Limit 2025 Beryle Leonore, The earnings limits for beneficiaries under full retirement age will increase. 50% of anything you earn over the cap.

Workers become eligible for retirement benefits at age 62 even if they are still.

For every $2 over the limit, $1 is withheld from benefits.